Arlington, Virginia -

E*TRADE from Morgan Stanley today announced results from the most recent wave of StreetWise, its quarterly tracking study of experienced investors. Results reveal inflation is top of mind for investors, and in response they are taking action:

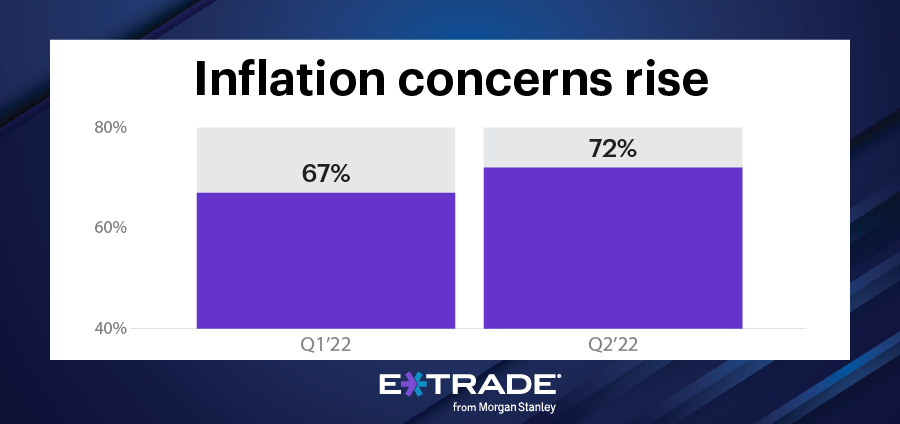

- Inflation concerns grow. Nearly three in four investors (72%) said they are extremely or very concerned about inflation, up 5 percentage points from last quarter.

- And investments are on the move. Nearly three in four (71%) investors said they have shifted their investment strategy due to rising inflation. Further, the Russia/Ukraine conflict (63%), crude highs (59%) and a rising rate environment (57%) have sparked portfolio changes. Two out of three investors (66%) say they will make portfolio moves in the next 6 months.

- Views mixed on if inflation hit its peak. More than half (54%) of investors said they believe we have reached the peak of inflation and it will begin to slow, but 46% believe there’s more room for inflation to run.

- Some are adding to their portfolios amid inflation. Two in five investors (40%) said they are investing more in this inflationary environment.

“It’s encouraging to see investors taking inflation risk seriously, especially when you consider that we haven’t seen an inflationary environment like this in decades,” Mike Loewengart, Managing Director of Investment Strategy at E*TRADE from Morgan Stanley. “But adjusting for this new type of market environment should not necessarily translate into selling out of existing positions and into cash. While we may be facing a pretty seismic shift in the investing landscape, remaining true to your long-term goals, risk tolerance, and time horizon can help keep you on track. Ebbs and flows like we’re seeing today, while scary, are all part of participating in the market.”

Mr. Loewengart offered additional investing considerations amid high inflation:

- Keep emotions at bay. While it can be difficult to sit tight during market swings, it’s best to remain committed to a long-term investment plan. Selling during a dip will only lock in losses. And looking at historic moments of volatility more broadly, investors who chose to sit on the sidelines after the financial crisis missed out on some of the material gains.

- Diversify, diversify, diversify. While a diversified portfolio should help weather varying market conditions and there’s no perfect hedge against inflation, equities have tended to keep up with, or stay a little ahead of, inflation. Treasury inflation-protected securities (TIPS), commodities, and REITs could also help diversify during elevated inflation.

- Employer benefits could offset pain points. Many employers offer financial wellness benefits that can help you stay on track as prices rise. Student loan repayment, employer matches to retirement contributions, and financial coaching tools are often offered and can help prepare you for challenging times and the future.

About the Survey

This wave of the survey was conducted from April 1 to April 11 of 2022 among an online US sample of 913 self-directed active investors who manage at least $10,000 in an online brokerage account. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands.

About E*TRADE from Morgan Stanley and Important Notices

E*TRADE from Morgan Stanley provides financial services to retail customers. Securities products and services offered by E*TRADE Securities LLC, Member SIPC. Investment advisory services offered by E*TRADE Capital Management, LLC, a Registered Investment Adviser. Commodity futures and options on futures products and services offered by E*TRADE Futures LLC, Member NFA. Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC. All are separate but affiliated subsidiaries of Morgan Stanley. More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE from Morgan Stanley, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE from Morgan Stanley. ETFC-G

ETFC

© 2022 E*TRADE from Morgan Stanley. All rights reserved.

E*TRADE engages Dynata to program, field, and tabulate the study. Dynata provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.dynata.com.

Referenced Data

How concerned are you about inflation? |

||

|

Q1’22 |

Q2’22 |

Top 2 Box |

67% |

72% |

Extremely concerned |

34% |

35% |

Very concerned |

33% |

37% |

Somewhat concerned |

30% |

25% |

Not at all concerned |

3% |

3% |

Please rate how each of the following events have shifted your investment strategy: |

|

Top 2 Box summary (Very much changed and somewhat changed) |

Q2’22 |

High inflation |

71% |

Russia/Ukraine conflict |

63% |

Crude hitting all-time highs |

59% |

Rising rate environment |

57% |

When it comes to your portfolio for the next six months are you considering any of the following strategies? |

|

|

Q2’22 |

Top 3 Box |

66% |

Change the allocations in my portfolio |

27% |

Move out of cash and in to new positions |

23% |

Move out of current positions and in to cash |

16% |

Make no changes to my portfolio |

33% |

Other |

1% |

Please rate how much you agree with the following statement about inflation. ** We have reached the peak of inflation and it will begin to slow. ** |

|

|

Q2’22 |

Top 2 Box |

54% |

Strongly agree |

16% |

Somewhat agree |

38% |

Somewhat disagree |

32% |

Strongly disagree |

14% |

Bottom 2 Box |

46% |

Amid high inflation, would you say you are investing more or less in the market? |

|

|

Q2’22 |

Top 2 Box |

40% |

Much more |

14% |

Somewhat more |

26% |

Neither more or less |

42% |

Somewhat less |

14% |

Much less |

4% |

Contacts:

E*TRADE Media Relations

646-521-4418

mediainq@etrade.com