Steve Edwards, CFA, Senior Investment Strategist

Patrick Gremban, Investment Strategist

Helen K. Donnelly, Investment Strategist

The authors would like to acknowledge Joshua Shek, CFA and Rich Baker, CEP for their contributions to this report.

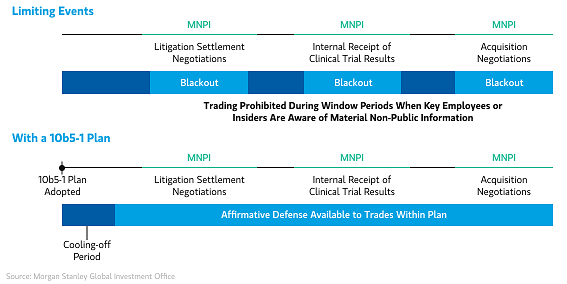

When selling company shares, corporate executives and other insiders must pay careful attention to ensure compliance with corporate policies and Securities and Exchange Commission (SEC) rules. First, insiders can only sell during “open windows,” lasting usually only four to six weeks after each earnings release. In addition, insiders cannot sell when they have material nonpublic information (MNPI) about the company or its securities. 10b5-1 plans may offer a solution and are designed to address these issues.

Steve Edwards, CFA, Senior Investment Strategist

Patrick Gremban, Investment Strategist

Helen K. Donnelly, Investment Strategist

The authors would like to acknowledge Joshua Shek, CFA and Rich Baker, CEP for their contributions to this report.

10b5-1 plans allow corporate executives and other insiders to establish preset trading plans for transacting in company stock holdings. The SEC created this opportunity in 2000, with the introduction of Rule 10b5-1, which clarified that trading while aware of MNPI about the issuer or its securities was a violation of insider-trading rules. Moreover, the SEC included guidelines within the Rule that, if followed, would provide an affirmative defense against claims of insider trading.

10b5-1 plans can help executives and other insiders meet their goals, particularly with regard to potentially diversifying holdings and reducing idiosyncratic risks associated with concentrated positions. As noted above, these plans may provide an affirmative defense against claims of insider trading. Once established, they permit insiders to trade during “closed windows” (also known as blackout periods) when those insiders may have MNPI. In addition, insiders may exercise employee stock options—and effect the immediate sale of the underlying shares—during otherwise prohibited periods while protecting against hitting option expiry dates. Given their preset nature, these plans automate insiders’ trading plans, customized to an individual’s particular objectives, down to specific amounts and timing. That feature protects investors against “emotional” selling and mitigates potential negative signaling from liquidating their holdings.

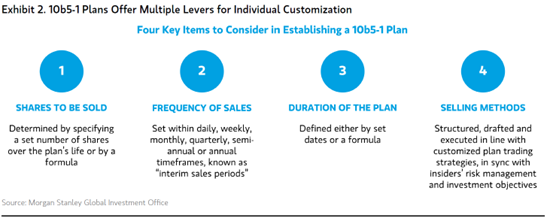

Executives and other insiders are required to implement a plan when they are not aware of material nonpublic information and to act in good faith with respect to the plan. The plan, including its subsequent trading schedule, may be highly customizable. When establishing a 10b5-1 plan, insiders may consider the following variables: the number of shares to be sold, frequency of sales and the duration of the plan. Inputs can be formula-driven or static.

Exhibit 1. 10b5-1 Plans Broaden Insiders’ Opportunities for Liquidating Concentrated Positions, Potentially Leading To Greater Diversification and Lower Exposure To Idiosyncratic Risks

Executives and other insiders should consider the following steps when adopting 10b5-1 plans, which may extend to multiple types of equity, such as restricted stock units and founder shares, as well as to stock options:

1. Determine diversification objectives. The plan’s goal could include the desired amount of total liquidity to generate, the quantity of shares intended for sale in a given sales period or the amount of company exposure to maintain. Of course, should the insider increase the liquidation amount, he or she will maintain a smaller amount of company exposure.

2. Look beyond assets held in your name. Insiders may consider related entities, including trusts and family members that hold shares, in their diversification strategies, potentially including those shares in any 10b5-1 plan. We recommend working with a financial advisor to develop a holistic strategy for your entire balance sheet.

3. Establish a selling frequency. For 10b5-1 plans, the time between sales is measured typically in months or quarters, based on the timing of individual liquidity needs. Shorter times between sales generate liquidity more frequently and may serve as a method of dollar-cost averaging out of a concentrated position rather than selling at a single point, which may increase vulnerability to price fluctuations.

4. Set the minimum price (“limit price”). This price represents the level at which the investor would be willing to liquidate shares, given the following: Sale information will become publicly available after the trade execution. Other investors will scrutinize Form 144- or Form 4-reported sales in the context of recent valuation points, such as the initial public offering (IPO) price or the price of any secondary offering.

5. Consider including upper-limit prices. These levels, set above the minimum price, indicate the prices at which additional shares may be sold. Upper limits allow clients to account for potential stock appreciation and upside volatility.

6. Determine the plan length. 10b5-1 plans typically have a 12- month duration, and other investors and regulators may scrutinize any modifications or early terminations. Longer plans may become susceptible to modifications or terminations, due to changes in investor or company circumstances. Shorter plans may increase the possibility of the insider being prevented from adopting a subsequent plan in a timely manner given awareness of MNPI.

7. Review any tax implications with trusted tax advisors. Given the complexity of equity compensation, we recommend that insiders work closely with tax professionals to optimize the tax implications related to any liquidity or option-exercise strategy. In terms of putting together the plan, there are a variety of common selling strategies to consider, which the plan may incorporate or combine, tailored to an executive’s or other insider’s needs and goals:

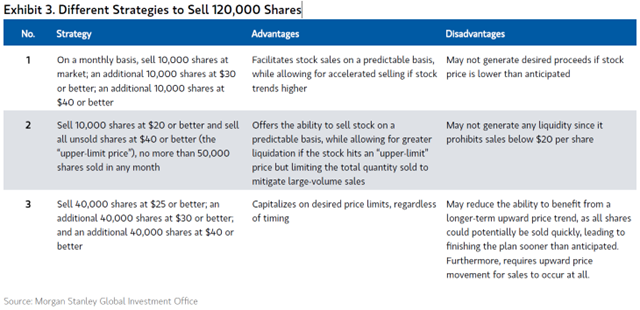

Below, we present a quick case study that compares different trading strategies, with the intention of showcasing each one’s advantages and disadvantages. In this case study, our hypothetical client has 500,000 shares in her company and wishes to sell 120,000 shares over a one-year period to help generate liquidity for upcoming expenses.

Although 10b5-1 trading plans offer many benefits, in 2022 the SEC amended the Rule to include additional requirements. Prior to these Rule changes, many commentators alleged that insiders abused Rule 10b5-1 trading plans—by adopting a plan without any “cooling-off” period, for example. The amendments, partially in response to those concerns, include the following:

Although these requirements may appear daunting at first, 10b5-1 plans remain useful for most corporate executives and other insiders.

Not all insiders may benefit from 10b5-1 plans, however. There are also considerations relating to 10b5-1 plans beyond those requirements of the rule itself. For example, insiders should consider company trading policies applicable to 10b5-1 plans as these policies often impose additional requirements on these plans (e.g., company approval of adoptions and terminations, no-sale periods around earnings). In addition, companies are now required to disclose in their annual 10-K and quarterly 10-Q reports publicly filed with the SEC when Section 16 directors and officers have adopted a plan, and the material terms of the plan (excluding pricing), as well as early plan terminations. Lastly, employees who typically do not encounter MNPI or are not subject to corporate window policies may not require a 10b5-1 plan.

Corporate executives and other insiders may consider using 10b5-1 plans to reach their diversification goals. Tailoring an optimal strategy will depend on the client’s specific circumstances, needs and preferences. Please reach out to your Morgan Stanley Financial Advisor or our 10b5-1 team to see how we can help sort through the details.

This material has been prepared for informational purposes only and is not a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Information and data contained herein have been obtained from multiple sources and Morgan Stanley Smith Barney LLC (“Morgan Stanley”) makes no representation as to the accuracy or completeness of the information and data from sources outside of Morgan Stanley. We have included information that we found to be pertinent for our purposes. We make no representation as to the completeness of the information, and information which you may find material for your own investment or planning purposes may not have been included. The information and data are subject to change at any time without notice.

This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

The information provided in this material is affected by laws and regulations in effect from time to time. It also is affected by facts and assumptions regarding your life circumstances which may change from time to time. Morgan Stanley undertakes no obligation to update or correct this information as laws, regulations, facts and assumptions change over time. If you have a change in your life circumstances that could impact your investment or planning, it is important that you keep your financial, tax and legal advisors informed, as appropriate.

Morgan Stanley Smith Barney LLC, its affiliates, employees and Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning, charitable giving, philanthropic planning and other legal matters.

Individuals executing a 10b5-1 trading plan should keep the following important considerations in mind:

(1) 10b5-1 trading plans should be reviewed and approved by the legal and compliance department of the individual’s company.

(2) Recent rule changes require a mandatory cooling-off period between the execution of a 10b5-1 trading plan (or a material modification) and the first sale pursuant to the plan (or the first sale following such material modification).

(3) 10b5-1 trading plans do not alter the nature of restricted and/or control stock or regulatory requirements that may otherwise be applicable (e.g., Rule 144, Section 16, Section 13).

(4) 10b5-1 trading plans that are modified or terminated early may require new cooling-off periods and may weaken or cause the individual to lose the benefit of the affirmative defense.

(5) 10b5-1 trading plans may require a cessation of trading activities at times when the company engages in securities offerings or when lockups may be required at the company (e.g., secondary offerings).

(6) Recent rule changes require companies to publicly disclose material terms of Section 16 director and officer 10b5-1 trading plans, and the adoption, material modification or early termination of such plans.

Morgan Stanley at Work services are provided by Morgan Stanley Smith Barney LLC, member SIPC, and its affiliates, all wholly owned subsidiaries of Morgan Stanley.

© 2025 Morgan Stanley Smith Barney LLC. Member SIPC.

CRC#4315191 (03/2025)